HUNTSVILLE, Ala. — For one weekend in July, you will have the chance to purchase back-to-school items without paying state or local taxes. This weekend is known as the annual Alabama Back-to-School Sales Tax Holiday. This includes qualifying school supplies, computers and clothing that will be exempt from Alabama’s 4% state tax, as well as any local taxes in participating counties.

What can I buy during Tax-Free Weekend in Alabama?

Alabama’s Sales Tax Holiday is to help families prepare for the coming school year. From Friday, July 15 at 12:01 a.m. to Sunday, July 17 at midnight during Tax-Free Weekend, certain back-to-school items will be exempt from the sales tax if they fall below a certain price. See eligible items below.

School supplies, school art supplies and school instructional materials under $50 per item.

- Examples include book bags, notebooks, calculators and lunch boxes.

Clothing under $100 per item.

- Examples include jeans, shirts, dresses, jackets, school uniforms and shoes.

Computers, computer software, and school computer supplies under $750 per item.

- Examples include laptops, monitors, keyboards, printers and software.

Books up to $30 per book.

- Fiction and non-fiction for all ages, as long as it is bound together and published in a volume with an ISBN number.

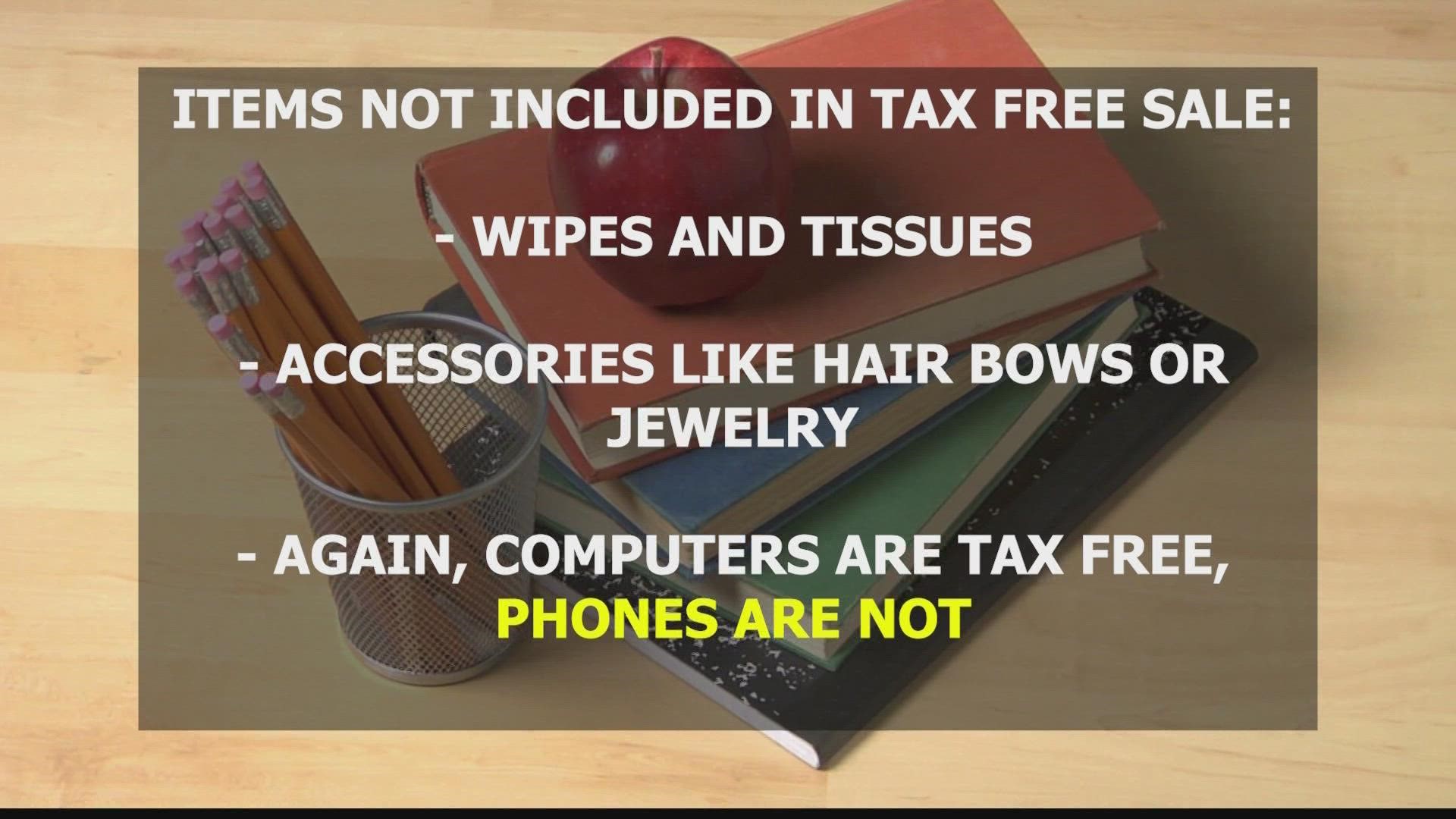

Products not exempt from sales tax during Alabama’s Tax-Free Weekend

But before you whip out your credit card, keep in mind that not every back-to-school item will escape sales tax during Alabama’s Tax-Free Weekend.

The following products will remain taxable during the holiday:

Newspapers and magazines.

Jewelry, cosmetics and hair accessories.

Protective or sport equipment (tool belts, soccer cleats etc).

Wallets, sunglasses and umbrellas.

Video games, smartphones and tech of a non-educational nature.

Desks, chairs and other furniture.

Alabama tax-free weekend FAQs

Can I apply a coupon or discount towards tax-free item?

Yes. Coupons and discounts may be applied to eligible products. If the discounted sale price falls below the designated limit, the product will qualify for the tax exemption—even if the retail price does not. To find coupons and deals to apply to your purchases, check out our school supplies, clothing and computer offers.

Can I use a gift card to buy exempt items?

Yes. You can buy exempt items with a gift card, but you cannot use a gift card to lower the purchase price of an item so it is eligible for exemption.

Does Alabama Tax-Free Weekend apply to online purchases?

Yes. Mail, telephone and online sales qualify for waived sales tax when the item is paid for and sent to the purchaser (in the state of Alabama) during the tax-free period.

How can the state do this? Does this affect state tax revenue?

According to Nancy Dennis, Director of Public Relations at the Alabama Retail Association, it doesn't have as big of an effect as you might think. "There is a loss, you're gonna lose that revenue, local revenue that would come in from your sales tax, but people are buying plenty of things that are taxed. Food is taxed. lodging is taxed. Gas is taxed, you know, all those things. They're buying plenty of that of the other things that that it doesn't really have a big impact on the state as a whole."