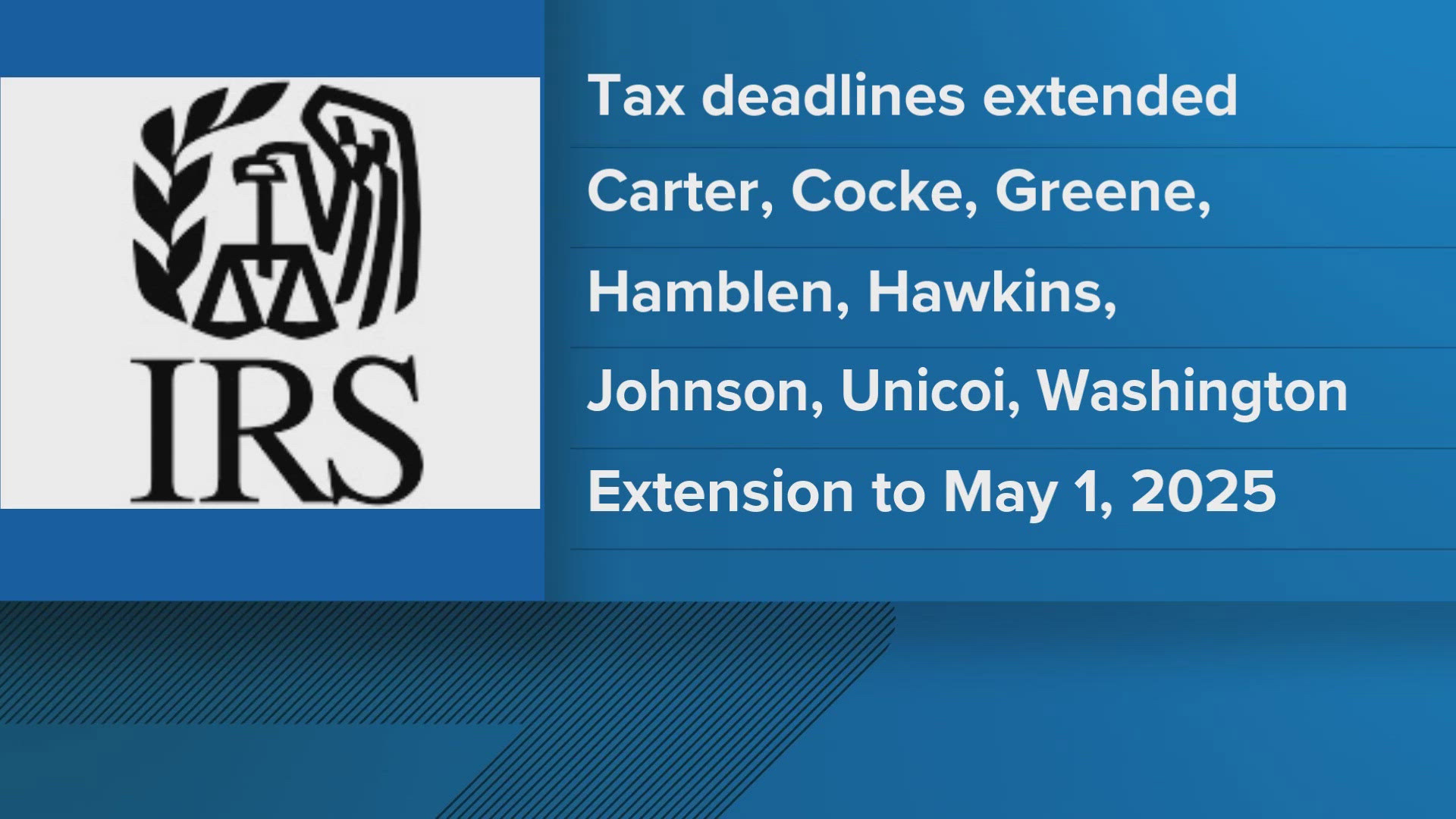

TENNESSEE, USA — The Internal Revenue Service announced Wednesday that tax relief would be available for individuals and businesses in parts of Tennessee affected by Hurricane Helene, according to a release. Taxpayers now have until May 1, 2025 to make tax payments and file various federal individual and business tax returns.

Individuals, households and businesses residing in Carter, Cocke, Greene, Hamblen, Hawkins, Johnson, Unicoi and Washington counties qualify for tax relief, the release said.

The IRS has also been permitted to postpone certain tax-filing and tax-payment deadlines for taxpayers in these counties. Certain deadlines falling on or after Sept. 26, 2024, are now granted additional time to file through May 1, 2025. As a result, affected individuals and businesses will now have until that May 1 deadline to file returns and pay any taxes originally due during that period, the IRS said.

According to the release, the May 1 filing deadline applies to:

- Individuals who had a valid extension to file their 2023 return due to run out on Oct. 15, 2024. The IRS noted, however, that because tax payments related to these 2023 returns were due on April 15, 2024, those payments are not eligible for this relief.

- Calendar-year corporations whose 2023 extensions run out on Oct. 15, 2024

The May 1 deadline also applies to payments normally due during this period, including quarterly estimated tax payments, as well as quarterly payroll and excise tax returns. Penalties on payroll and excise tax deposits due on or after Sept. 26, 2024, and before Oct. 11, 2024, will also be abated as long as the tax deposits are made by Oct. 11, 2024, according to the release.

The IRS says that it will automatically identify and apply filing and payment relief to taxpayers in the covered disaster area. Affected taxpayers who live or have a business outside the covered areas should contact the IRS disaster hotline at 866-562-5227 to request relief.

For more information about affected taxpayers, casualty losses and more, click here.